First Steps to Creating a Cloud Computing Strategy for 2013

2013 will be one of the most pivotal years for cloud computing because trust in these technologies is on the line.

2013 will be one of the most pivotal years for cloud computing because trust in these technologies is on the line.

Expectations are high regarding these technologies’ ability to deliver business value while reducing operating costs. Enterprises’ experiences have at times met these high expectations, yet too often are getting mixed results. Managing cloud expectations at the C-level is quickly emerging as one of the most valuable skills in 2013. The best CIOs at this are business strategists who regularly review with their line-of-business counterparts what is and isn’t working. These CIOs who are excelling as strategists also are creating and continually evaluating their cloud computing plans for 2013. They are focusing on plans that capitalize the best of what cloud computing has to offer, while minimizing risks.

CIOs excelling as strategists are also using cloud computing planning to punch through the hype and make cloud technologies real from a customer, supplier and internal efficiency standpoint. Lessons learned from these cloud computing planning efforts in enterprises are provided below:

- Cloud computing needs to mature more to take on all enterprise applications, so plan for a hybrid IT architecture that provides both agility and security. This is a common concern among CIOs in the manufacturing and financial services industries especially. As much as the speed of deployment, customization and subscription-based models attract enterprises to the cloud, the difficult problems of security, legacy system integration, and licensing slow its adoption. There is not enough trust in the cloud yet to move the entire IT infrastructure there in the majority of manufacturing companies I’ve spoken with.

- Reorganizing IT to deliver greater business agility and support of key business initiatives will be a high priority in 2013. The gauntlet has been thrown at the feet of many CIOs this year: become more strategic and help the business grow now. Cloud is part of this, yet not its primary catalyst, the need to increase sales is. IT organizations will increasingly reflect a more service-driven, not technology-based approach to delivering information and intelligence to the enterprise as a result.

- Recruiting, training and retaining cloud architects, developers, engineers, support and service professionals will be a challenge even for the largest enterprises. There isn’t enough talent to go around for all the projects going on and planned right now. State Farm Insurance has 1,000 software engineers working on their mobility applications for claims processing and quoting for example. And they are hiring more. Certifications in cloud technologies are going to be worth at least a 30 to 50% increase in salary in specific positions. This is very good news for engineers who want to differentiate themselves and get ahead in their careers, both financially and from a management standpoint.

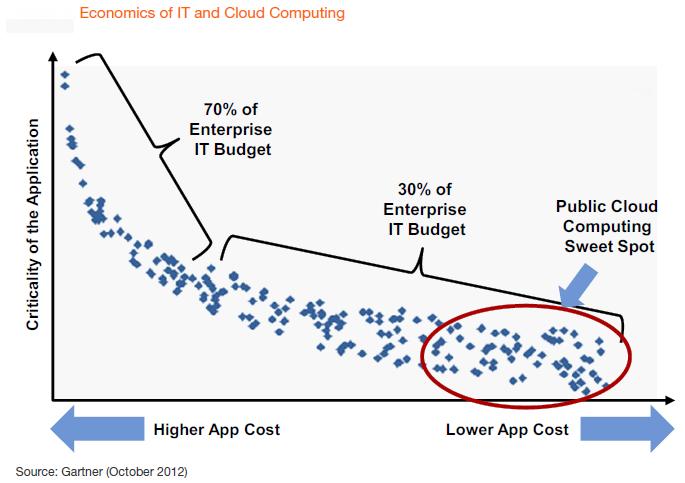

- Measuring the contributions of operating expense (OPEX) reductions is going to become commonplace in 2013. From the cloud computing plans I’ve seen, OPEX is being tracked with greater accuracy than in any other year and will be a strong focus in the future. The capital expense (CAPEX) savings are clear, yet OPEX savings in many cases aren’t. Cloud computing’s greatest wins in the enterprise continue to be in non-mission critical areas of the business. This is changing as cloud-based ERP systems gain adoption within businesses who are constrained by monolithic ERP systems from decades ago. Plex Systems is a leader in this area and one to watch if you are interested in this area of enterprise software. SaaS is dominating in the area of lower application costs and high user counts, which is the Public Computing Sweet Spot in the following graphic:

- Start building a SaaS application review framework including Service Level Agreement (SLA) benchmarks to drive greater transparency by vendors. Gartner forecasts that the SaaS-based cloud market will grow from $12.1B in 2013 to$21.3B in 2015, with the primary growth factors being ease of customization and speed of deployment. CIOs and their staffs have SaaS frameworks already in place, often with specific levels of performance defined including security and multitenancy audits. SLAs are going to be a challenge however as many vendors are inflexible and will not negotiate them. At a minimum make sure cloud service providers and cloud management platforms (CMP) have certifications for ISO 27001 and Statements on Standards for Attestation Engagements (SSAE) No. 16, as this shows the provider is making investments in availability, security and performance levels.

- Create a Cloud Decision Framework to keep technology evaluations and investments aligned with business strategies. Business and application assessments and the vendor selection process need to take into account application requirements, role of external cloud resources, and how the RFI will be structured. These process areas will vary by type of company – yet concentrating in application requirements goes a long way to reducing confusion and forcing trade-offs in the middle of a review cycle. The following is an example of a Cloud Decision Framework:

- Mitigating risk and liability through intensive due diligence needs to become any cloud-based companies’ core strength. Regardless of how the HP-Autonomy litigation is resolved it is a powerful cautionary tale of the need for due diligence. And let’s face it: there are way too many SaaS companies chasing too few dollars in the niche areas of enterprise software today. A shakeout is on the way, the market just can’t sustain so many vendors. To reduce risk and liability, ask to see the financial statements (especially if the vendor is private), get references and visit them, meet with engineering to determine how real the product roadmap is, and require an SLA. Anyone selling software on SaaS will also have revenue recognition issues too, be sure to thoroughly understand how they are accounting for sales.

- Design in security management at the cloud platform level, including auditing and access control by role in the organization. One manufacturing company I’ve been working with has defined security at this level and has been able to quickly evaluate SaaS-based manufacturing, pricing and services systems by their security integration compatibility. This has saved thousands of dollars in security-based customizations to meet the manufactures’ corporate standards.

Bottom line: 2013 is the make-or-break year for cloud in the enterprise, and getting started on a plan will help your organization quickly cut through the hype and see which providers can deliver value.