FinancialForce Unleashes Spring ’23 Release, Strengthening Opportunity-to-Renewal

Finding new ways to improve opportunity-to-renewal is core to any services business’s growth.

FinancialForce has long bet its business on the belief that it could streamline opportunity-to-renewal for people- and software-centered businesses better than any other vendor. In delivering their Spring ’23 release, they’re proving how adept they are at delivering new features on a faster release cadence of three major releases a year. Out of its workforce of 1,000 people, FinancialForce has 400 full-time employees in DevOps, engineering, product management, and quality and nearly 100 outside resources in R&D.

FinancialForce’s overarching goal with the Spring ’23 release is to strengthen the customer’s ability to excel at opportunity-to-renewal. The feature refresh for Spring ’23 includes 18 different areas of their platform, with the most, eight, being in Services CPQ. Dan Brown, Chief Product, and Strategy Officer at FinancialForce, says, “Opportunity-to-renewal is core to companies that deliver services. It’s an area that has been dramatically underserved by classic vendors in this space. Most are fairly product-centric, and that tends to hold companies that are service-oriented back.”

Services-as-a-Business is gaining traction

FinancialForce’s Spring ’23 release shows how Services-as-a-Business is closing gaps and improving the opportunity-to-renewal process. Tight labor markets, spiraling costs and prices due to inflation, and blind spots in opportunity-to-renewal cycles continually jeopardize services revenue. As a result, professional services and software companies relying on service revenue risk losing Annual Recurring Revenue (ARR) and seeing reduced Customer Lifetime Value for every account. The Spring ’23 release provides a more granular, 360-degree view across eight core areas of the opportunity-to-renewal process to help services businesses meet new growth challenges.

“Our new Spring ’23 release is designed to give organizations the kind of certainty they need in these very uncertain economic times,” said Scott Brown, President, and Chief Executive Officer at FinancialForce. “Given the pace at which market and business conditions change, services businesses need confidence in their ability to manage estimates, skills and resources, and solve complex problems. This new release gives organizations a complete, customer-centric view of their business to turn continuous disruption into a competitive edge.”

FinancialForce’s Spring ’23 release doubles down in the areas of Service CPQ and Resource Management, which are the areas where the majority of new features have been added in the Spring ’23 release.

Improving Services CPQ process performance protects margins

FinancialForce is prioritizing Services CPQ, first introduced in the Winter ’22 release, to help customers get more in control of their margins and time management. The number and depth of new features in this area and Dan Brown’s insights into how popular Services CPQ has become with enterprise accounts demonstrate that prioritization. FinancialForce’s enterprise accounts are adopting Services CPQ to save time during sales cycles by providing their prospects with the visibility to identify resources available for quoting work, their billable rate, skills, and previous experience.

Dan Brown said that “in (quote) estimation, you now can reach into your PSA (Professional Services Automation) system and identify the resource that you’re going to quote, what’s their billable rate, what’s their skills, what’s their capabilities. A big issue our customers have is that the As Quoted versus the As Delivered are almost always materially very different.”

He continued, emphasizing, “And that’s where you end up with margin erosion, that’s where you end up with revenue leakage for our customers. Now with Services CPQ, the As Quoted and As Delivered features are tightly linked together. And that has driven enormous improvements.”

Scott Brown added, “When I was a customer, this was a big pain point. For me, the capability to connect your pre-sales activities to your post-sale delivery is a real game changer for us.”

Underscoring how vital Services CPQ is to FinancialForce’s opportunity-to-renewal strategy, the Spring ‘23 Customer Overview notes that “with usability improvements in Services CPQ, support for additional pricing and costing scenarios, and streamlined estimate export for correct Statements of Work, services teams will be able to create accurate and competitive proposals faster, leading to higher win rates on projects, with much lower risk profiles.”

Among the many enhancements to Services CPQ are usability enhancements to the Estimate Builder, helping to reduce errors in As Quoted and As Delivered Results.

Among the many enhancements to Services CPQ are usability enhancements to the Estimate Builder, helping to reduce errors in As Quoted and As Delivered Results.

New features to optimize resources and projects

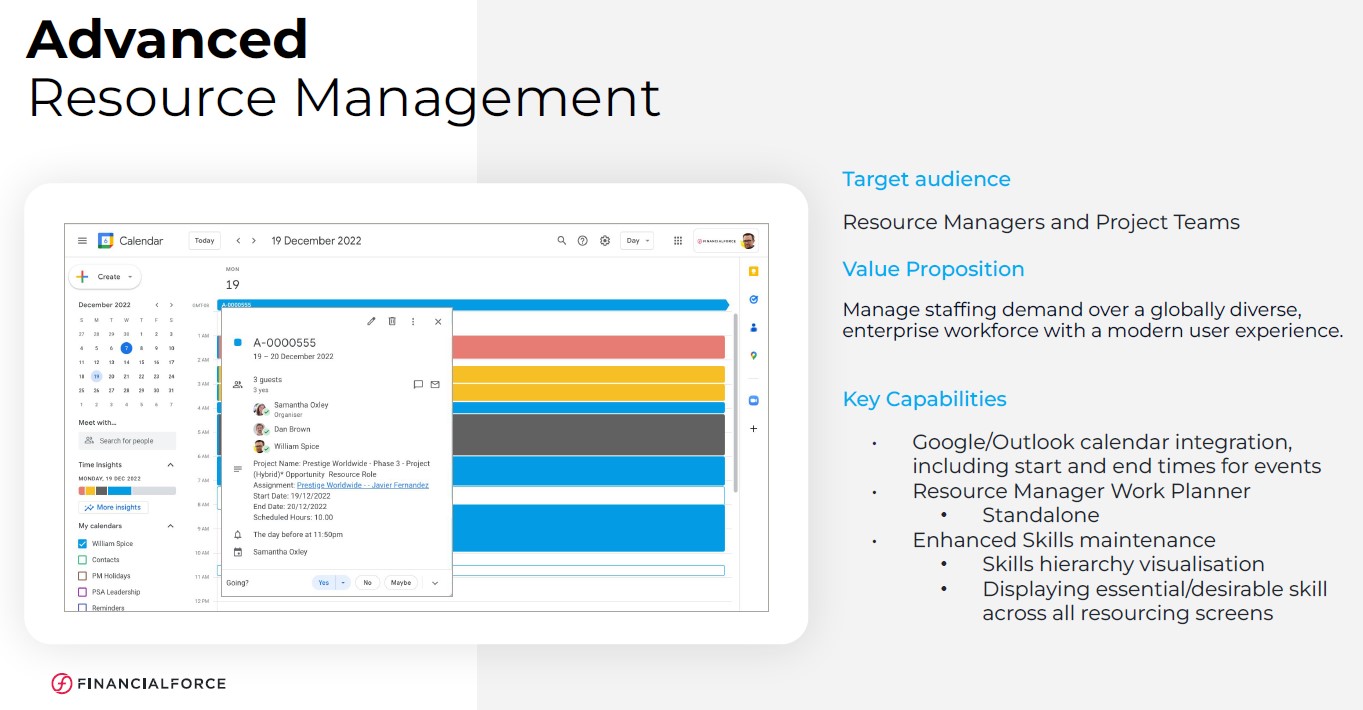

Additional goals of the spring ’23 release are to provide customers with improved workflows for optimizing resources and streamlining project management. Given how every professional services firm and software company today is under pressure to continually find new ways to optimize resources and be more done with less, the timing of Resource Optimizer Enhancements and introducing Resource Manager Work Planner is excellent. FinancialForce allows assigning multiple resources to project enhancements, integrating with MS Outlook and Google Calendar, as well as mass deletion of pass utilization results. FinancialForce also delivers task-based scheduling of held resource requests.

The Spring ’23 release is designed to help enterprises optimize resources from small-scale to multi-location projects by adding Resource Work Planner and Enhanced Skills Maintenance that can scale across multiple global locations.

How FinancialForce’s Spring ’23 Release Strengthens Opportunity-to-Renewal

“This new release gives organizations a complete, customer-centric view of their business to turn continuous disruption into a competitive edge,” remarked Scott Brown during a recent briefing. FinancialForce aims to help services businesses more efficiently monetize their time and resources by concentrating their development efforts across opportunity-to-renewal.

The release shows how services companies are looking to real-time financial analytics, including new risk management features, as guardrails to keep their businesses on track to margin and profit goals. The Spring ’23 release shows FinancialForce’s view of the opportunity-to-renewal process and what strengths it can offer customers, from a new Scheduling Risk Dashboard that provides early intervention and project course corrections in real time, to streamlined estimate exports for accurate Statements of Work (SOWs).

The following table uses the opportunity-to-renewal process as a framework to put the new release into context. It compares each phase of the opportunity-to-order process, how FinancialForce defines their role, how the Spring ’23 release strengthens each area, what the people and software-oriented benefits are, along with their leading customer references. You can also download a copy of the Opportunity-to-Renewal Process comparison here.