BCG Shares Their Insights On What Sets GenAI’s Top Performers Apart

The top 10% of enterprises have one or more GenAI applications in production at scale across their organizations. 44% of these top-performing organizations are realizing significant value from scaled predictive AI cases. 70% of top performers explicitly tailor their GenAI projects to create measurable value.

Boston Consulting Group (BCG) estimates that an organization with $20 billion in revenue can achieve gains of $500 million to $1 billion in profit using GenAI, with nearly a third of those gains coming in the first 18 months. Their recent analysis of what sets GenAI’s top performers apart, What GenAI’s Top Performers Do Differently, looks at the factors that most differentiate enterprises excelling with GenAI today.

What further differentiates these top performers from others is how they’re looking to use GenAI to redefine the functional areas of their organizations. They’re far more likely to have a solid foundation in predictive AI and four times more likely to increase their investment in AI and digital-first strategies and technologies.

Half of the enterprise leaders BCG interviewed say their organizations are testing GenAI in pilot projects today but have not achieved full-scale implementation. The remaining 40% haven’t taken any action on GenAI yet.

What Sets The Top 10% Apart

Two-thirds of GenAI’s top-performing enterprises aren’t digital natives like Amazon or Google but instead leaders in biopharma, energy, and insurance. BCG found that a U.S.-based energy company launched a GenAI-driven conversational platform to assist frontline technicians, increasing productivity by 7%. A biopharma company is reimagining its R&D function with GenAI and reducing drug discovery timelines by 25%.

Top GenAI performers have their greatest lead over peers across five main capabilities. These capabilities include having a clear link to business performance, modern technology infrastructure, strong data capabilities, leadership support, and a grounding in responsible AI. The steep curves shown in the graphic below suggest how these five most differentiated capabilities are essential for successful GenAI adoption at scale.

Key takeaways from BCG’s analysis of GenAI top performers

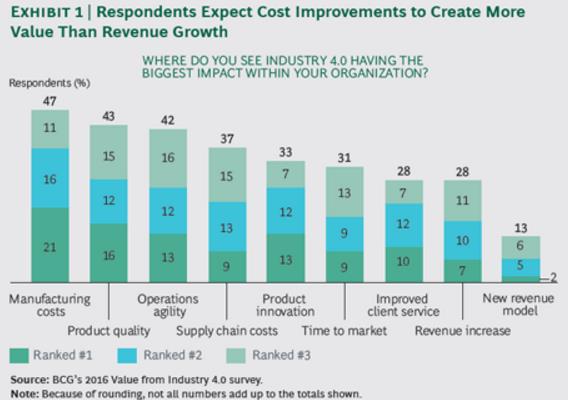

Top performers excel at creating strong links between GenAI initiatives and business value. Seven in ten enterprises who are high achievers know how to build a business case for their GenAI projects and pilots. They’re focused on measuring results and quantifying value. BCG found that in a typical GenAI portfolio, 60% of the initiatives are focused on reducing costs and 40% on increasing revenue.

An all-in mindset when it comes to maintaining and growing a modern technology infrastructure. GenAI top-performing enterprises are three times more likely to already have a modular, modern IT tech stack and supporting infrastructure in place. They’re focused on being prepared to develop new, GenAI-powered services on their current and future AI models while supporting DevOps. BCG says top performers are 1.5 times more likely to focus on building the GenAI stack internally over the coming three years, underscoring their desire to make the technology a core capability for the organizations.

Are pursuing and advanced data strategy that includes unstructured data. GenAI top performers are two times more likely to have data pipelines and data management practices in place to streamline data sourcing and storage. They’re also more likely to have unstructured data expertise. BCG observes that an advanced data strategy “is a critical element of GenAI, given that models are only as strong as the data on which they’re trained.” Organizations have found success with less mature skills in these areas, although it may take longer as they need to address infrastructure and data strategy gaps or shortcomings.

Strong leadership support for innovation, including the willingness to champion GenAI. Senior executives’ support and prioritizing an innovative culture are the most differentiating factors in defining GenAI’s high performers. Gen AI high performers who are scaling use cases are three times more likely than no-action companies to have leaders who prioritize innovation and actively support GenAI. BCG notes that these leaders often have a deep understanding of the technology’s potential impact on their industry, and they are publicly committed to ensuring that the organization capitalizes on it in new ways that generate value. “Visible support and commitment from our leadership team has been crucial, as it provided the freedom to experiment and deal with failures along the way,” said the head of data and analytics at a global media company referenced in BCG’s report.

Have responsible AI guidelines, guardrails and processes in place. Top-performing enterprises are more likely to have responsible AI frameworks, guidelines, and guardrails in place. BCG observes that a common trait top-performing enterprises have is ensuring their AI systems and workflows put humans in the loop and use only factual data. “Our research shows that leading companies are far more likely to have developed guardrails, guidelines, and policies to ensure that they follow the principles of responsible AI. In the findings, the share of scaling companies that are cautious about the potential misuse of GenAI and taking proactive measures to address these risks is 20 percentage points higher than the share of companies taking no action in this area,” write BCG’s researchers.